Transfer Pricing Services in UAE

Transfer pricing refers to the pricing of goods, services, or intangible assets transferred between entities within the same multinational enterprise group. The goal is to establish fair and arm's length prices for these transactions, ensuring that profits are appropriately attributed to each jurisdiction where the business operates. This helps prevent tax evasion and ensures that each country receives its fair share of taxes.

Key Principles of Transfer Pricing in the UAE

Transfer Pricing - Applicability in the UAE

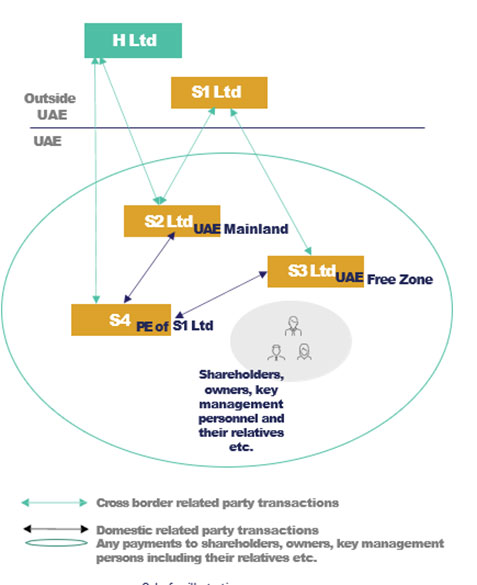

General applicability

- TP applies where there are related party transactions* and payments to connected persons*

- Transactions could be cross border as well as domestic

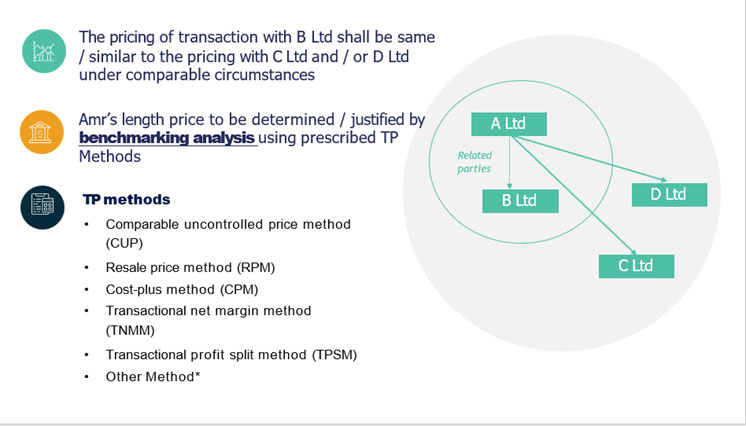

Transfer Pricing - Arm's length principle

Approach

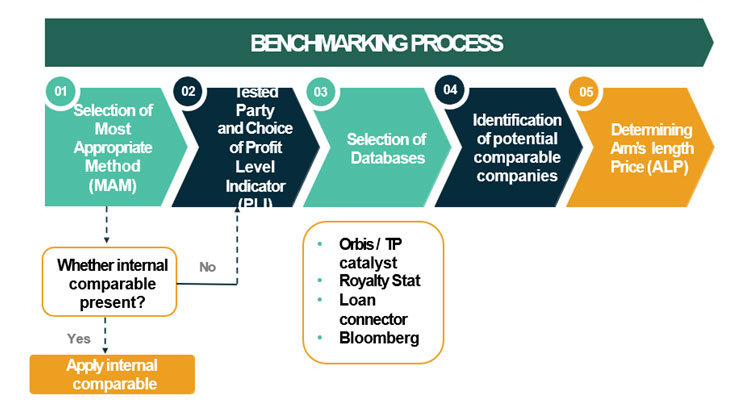

TP Benchmaking - Process

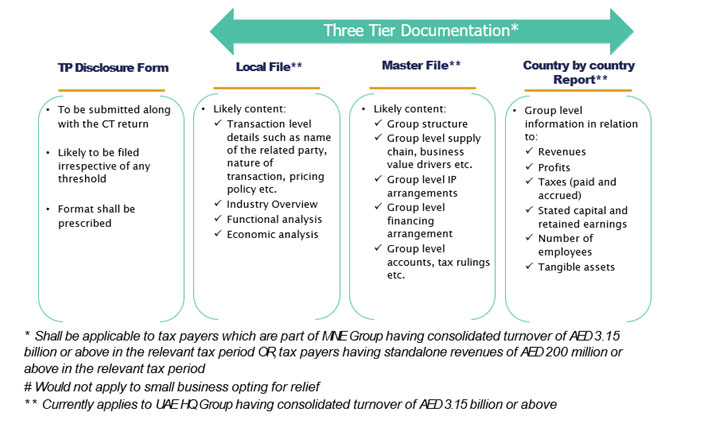

Transfer Pricing - Compliances

*Related party and connected person is defined under the law

#criteria of 50% shareholding and / or control has been followed

How can PB help in Transfer Pricing

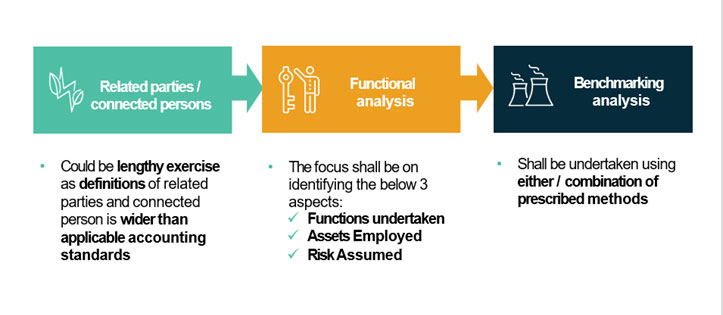

- Identification of related party / connected person transactions and arrangements

- Development of transfer pricing mechanisms and policies and ensure they conform to OECD guidelines and local country regulations

- Preparation of Transfer Pricing studies and reports based on FAR Analysis and performing economic and benchmarking analysis and commenting on pricing mechanism

- Assistance with transfer pricing documentation requirements to support the positions adopted including preparation and filing of transfer pricing disclosure forms, Master Files and Local Files

- Providing advisory on optimisation of supply chain structures from tax perspective