UAE Corporate Tax

The UAE has introduced the "Corporate Tax Law," to regulate the taxation of corporations and businesses within the country. Issued on 09 December 2022, the Corporate Tax Law serves as the foundational framework for the establishment and implementation of a Federal Corporate Tax (Corporate Tax) in the UAE. This legislation comes into effect for financial years commencing on or after 1 June 2023, signifying a significant milestone in the UAE's commitment to fostering economic growth and development.

Corporate Tax Rates in the UAE

Regular CT rates

- 0% on taxable income not exceeding AED 375,000

- 9% on taxable income exceeding AED 375,000

CT rates for Qualifying Free Zone Person

- 0% on qualifying income

- 9% on other taxable income which is not a qualifying income

CT rates for entities of large multinational Group#

- 15% (likely) on taxable income**

** as per FAQs issued by Ministry of Finance

# Group having present in more than one country and consolidated annual revenues of more than Euro 750 million

Who will need Corporate Tax?

The scope of UAE Corporate Tax encompasses juridical entities incorporated within the UAE and foreign juridical entities under effective management and control in the country. Additionally, foreign entities operating in the UAE through a Permanent Establishment or having a taxable presence will also fall under the purview of Corporate Tax.

For individuals, Corporate Tax obligations apply when they are involved in Business or Business Activities within the UAE, whether directly or through an Unincorporated Partnership or sole proprietorship.

How can PB help in Corporate Tax

Premier Brains offers comprehensive corporate tax services in the UAE, providing tailored solutions to meet your business needs. Our range of services includes:

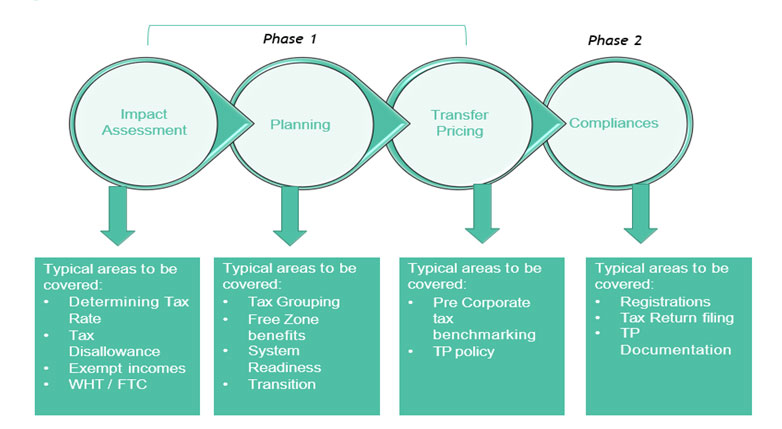

- Corporate tax impact assessment, planning, and implementation

- Transfer pricing impact assessment and benchmarking analysis

- Double taxation avoidance agreements advisory

- Tax Compliance

- Tax Training

- Tax Return Review and Filing

- Tax Advisory

- VAT Impact assessment

- Tax Audit assistance and preparation of documentation

- Tax registration and De-registration

- Tax registration Amendments on EmaraTax Portal

Our seasoned professionals also provide insightful advisory on Double Taxation Avoidance Agreements. With a commitment to excellence, we offer reliable tax compliance services, keeping your business in line with regulatory requirements. Moreover, Premier Brains takes pride in empowering your team through specialized tax training programs, fostering a proactive and knowledgeable approach to tax management.

How Premier Brains can help to prepare for Corporate Tax?