Introduction to Value-Added Tax (‘VAT’) in UAE?

VAT is an indirect tax imposed on the supply of goods and services and is charged at each stage of the supply chain. The end-consumer bears the VAT while registered taxpayers collect the tax on behalf of the government.

VAT was introduced in the UAE effective from 1 January 2018 at a standard rate of 5% and is imposed on goods and services supplied in the UAE. The VAT introduction allows the government to diversify the income sources. Further, this huge revenue source ensures continuing the good standard of living in the UAE.

The Federal Tax Authority (‘FTA’) was established under Federal Law by Decree No. 13 of 2016 and is UAE’s official tax authority that takes charge of managing and collecting federal taxes and related fines, as well as distributing tax-generated revenues and applying the tax-related procedures in the UAE.

Types of Supplies in VAT

Standard rated supplies

All supplies that fall within the scope of UAE VAT and are not subject to the zero-rate. VAT rate of 5% will be charged on such supplies.

Zero rated supplies

The following supplies are subject to VAT of 0% as an exception, provided that certain conditions for each supply (as mentioned in the VAT Law) are satisfied:

- ●

- A Direct or Indirect export of goods and services.

- ●

- International transport of goods and passengers, and transport-related services.

- ●

- Certain means of transport, such as trains, sea vessels and aircraft, and goods and services related to such means of transport.

- ●

- First supply of residential buildings (lease or sale) within 3 years of finalizing their construction.

- ●

- Airplanes and marine vessels designed for the purpose of rescue or aid through air or sea.

- ●

- Certain precious investment metals.

- ●

- First supply of buildings specifically designed for charitable institutions (lease or sale).

- ●

- First supply of buildings that were converted from non-residential to residential units (lease or sale).

- ●

- Crude oil and natural gas.

- ●

- Certain educational services and related goods and services

- ●

- Necessary and preventive healthcare services and related goods and services.

Import of goods and Services to UAE

When goods or services are received from outside UAE into UAE, VAT of 5% will be charged to the Importer of goods or services on a Reverse Charge Mechanism (‘RCM’) basis. This is in addition to customs duty levied by the Customs Authority (For Import of goods).

As per the default VAT rules, the supplier of goods or services is liable to collect and pay tax to the FTA. Under RCM, the recipient of the supply is liable to pay the tax on the supply to the FTA.

As the supplier is outside UAE and is hence, not registered in UAE, the liability to pay tax on the import is on the importer registered under VAT in UAE. The Input tax paid by the recipient of the supply on imports is eligible for input tax recovery provided supporting documentation is retained by the recipient.

Exempt supplies

These supplies are exempted under UAE VAT law, and businesses neither charge VAT nor claim input tax when selling or providing exempt goods or services provided certain conditions are satisfied (as mentioned in the VAT law).

Exempt supplies include:

- ●

- Certain financial services.

- ●

- Supply of residential units (lease or sale) if such supply is not subject to zero-rate.

- ●

- Bare land.

- ●

- Local passenger transport.

Deemed Supplies

These are the supplies that do not fall under the definition of supply; however, businesses must charge VAT. Deemed supplies in UAE include:

- ●

- Business assets sold without any consideration

- ●

- Transfer of business assets from UAE to other GCC Implementing States or vice versa, and

- ●

- Goods utilized for non-business purposes on which input tax is claimed, etc.

Registration for VAT

The VAT Law mandates that Business residents in UAE that makes taxable supplies within the UAE should / may register for VAT in the following scenarios by submitting an application to the FTA in its official website:

Mandatory VAT registration

If the total value of taxable supplies and imports exceeds the mandatory registration threshold of AED 375,000 over the previous 12 months, or the business expects to exceed it in the next 30 days.

Note: It is important to consider that businesses must know the exact date (through self-assessment) the mandatory registration threshold was exceeded and apply for VAT registration within 20 business days from this date.

Ex- Company A exceeded the Mandatory registration threshold on 15th January 2024. So, company A will be obliged to submit an application for VAT registration to the FTA within 20 business days from 15th January 2024.

Voluntary VAT registration

A business also has the option to register for VAT voluntarily if the total value of its taxable supplies and imports or taxable expenses in the previous 12 months exceeded the voluntary registration threshold of AED 187,500, or expects to exceed it in the next 30 days.

Registration can be carried out using the FTA’s official online tax service portal (Emaratax Portal) through the following steps:

- ●

- Sign-up for an e-services account through the FTA’s website and activate it.

- ●

- Access the e-services account dashboard and create a taxable person account by clicking on “Add New Taxable Person”.

- ●

-

Fill and submit the VAT registration application to the FTA by providing the required details and attaching the supporting documentation of the taxable person. Examples of supporting documentation are:

- >

- Valid trade license or business license

- >

- Passport (and Emirates ID in case of residency in the UAE) of the authorized signatory.

- >

- Proof of the authorized manager/signatory’s right to sign documents (e.g.: articles of incorporation, memorandum of association, power of attorney, etc.)

- >

- Owner details of the taxable person such Passport and Emirates ID (if UAE resident) if owner is a natural person or Trade License / Certificate of Incorporate if owner is a legal person.

- ●

- The FTA shall take 20 business days to review and approve the registration application. Once approved, a VAT registration certificate shall be issued for the taxable person which mentions the Tax Registration Number (TRN) and the Quarterly VAT periods assigned by the FTA.

Points to be considered:

Taxable person with Multiple Branches

A taxable person and all its branches shall be treated as the same person for the purposes of tax liability and shall receive only one TRN.

Tax Group

Related businesses that share economic, financial and regulatory ties (either in law, shareholding or voting rights) can be registered as a tax group if they have an establishment in the UAE, and all members of the group are legal persons under joint control.

A Tax Group application shall be submitted by the representative member who is nominated by the members of the Tax group to carry out the FTA related services on behalf of the group members. Registration as a Tax Group provides the following perks:

- ●

- Transactions between tax group members are disregarded for VAT purposes.

- ●

- Reduces the burden of submitting multiple VAT returns of the group members as only one consolidated VAT return shall be submitted by the representative member covering all the group activities.

Obligations post VAT registration

Issuance of Tax Invoices for each taxable sale of goods and services

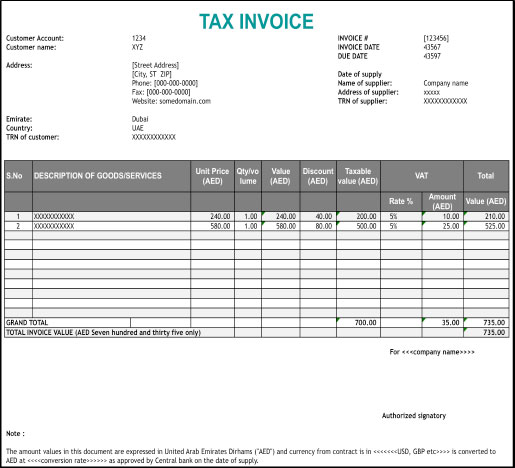

A registrant must issue valid tax invoices for each taxable supply of goods or services. The issuance of proper tax invoices is one of the tax compliance requirements that must be followed as per the VAT Law. A Tax Invoice shall include the below information:

- ●

- The words “Tax Invoice” clearly displayed on the invoice.

- ●

- The name, address and Tax Registration Number (TRN) of the supplier.

- ●

- The name, address and TRN (if registered for VAT) of the recipient.

- ●

- A sequential tax invoice number or a unique invoice number that enables the identification of the tax invoice and its number in any sequence of invoices.

- ●

- Date of issuance.

- ●

- The date of supply if it is different from the date of issuance.

- ●

- Description of the goods or services supplied.

- ●

- Unit price, the quantity or volume of the supply, the payable VAT rate and payable amount (in AED) for each good or service

- ●

- Any offered discount rates.

- ●

- Total amount payable in AED.

- ●

- The amount of the tax payable in AED and the applicable exchange rate.

- ●

- If the recipient is required to account for VAT, the invoice must include a reference to this, and a reference to the relevant provision of the Law

A registrant may issue a simplified Tax Invoice in the below scenarios:

- 1.

- When the recipient is not registered for VAT

- 2.

- Where the recipient is registered for VAT but the consideration for the supply does not exceed AED 10,000.

A simplified Tax Invoice must include the below information:

- ●

- The words “Tax Invoice” clearly displayed on the invoice.

- ●

- The name, address and TRN of the registered supplier.

- ●

- Date of issuance of the tax invoice.

- ●

- Description of the goods or services supplied.

- ●

- The total consideration and the VAT amount charged

Sample of Tax Invoice Format

Bookkeeping requirements

Records and supporting documentations must be retained for a minimum of 5 years after the end of the tax period, in cases where the taxable person owns real estate, the records relating to the real estate must be kept for a period of 15 years.

VAT registered businesses in the UAE must retain the following documentations in accordance with the requirements of tax legislation:

- ●

- Records of all supplies and imports of goods and services.

- ●

- All tax invoices, tax credit notes and alternative documents received and issued.

- ●

- Records of goods and services that have been disposed of or used for matters not related to the business, detailing the VAT paid on those goods and services.

- ●

- Records of goods and services purchased for which input tax has not been deducted.

- ●

- Records of exported goods and services

- ●

- Records of adjustments or corrections to accounts or tax invoices.

- ●

- Balance sheets and income statements (profit and loss accounts).

- ●

- Records of wages and salaries.

- ●

- Fixed asset records.

- ●

- Inventory records and statements (including quantities and values) held at the end of any relevant Tax Period and all records of stock-counts related to inventory statements.

- ●

- Any records as specified in tax law and other legislation

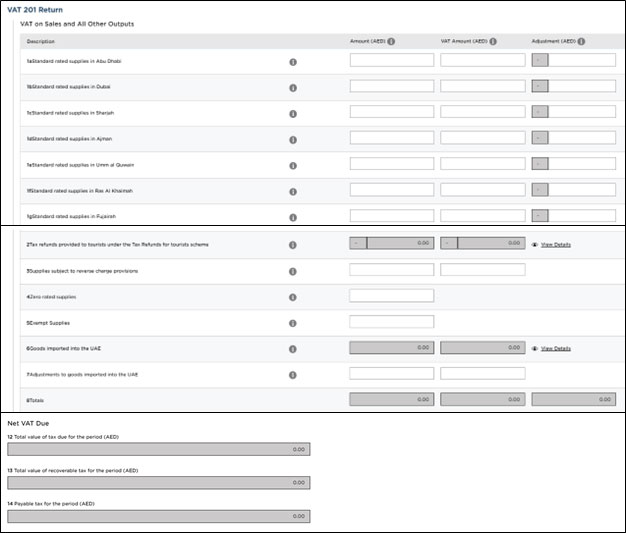

Submission of VAT returns on the Emaratax portal

The FTA usually allocates three-month tax periods (quarterly) to a VAT registrant and the tax return no later than the 28th day from the end of each tax period.

The FTA urges VAT registrants to file their VAT returns within the periods specified by even if there are no taxes payable for the relevant period. The VAT returns submitted on the FTA portal must include the following:

- ●

- The value of supplies subject to the standard tax rate made during the tax period and the imposed output tax, per Emirate. (Box 1a – Box 1g)

- ●

- Tax refunds provided to tourists under the Tax Refunds for Tourists Scheme, for retailers who provide tax refunds to tourists in the UAE under the official tourists refund scheme (Box 2)

- ●

- The value of supplies subject to the zero-rate provided during the tax period (Box 4)

- ●

- The value of provided supplies exempt from VAT during the tax period (Box 5)

- ●

- The value of supplies subject to Reverse Charge received during the tax period (Box 3 and Box 10)

- ●

- Goods imported into the UAE (Box 6 will be auto populated in the portal if the TRN is linked to the Customs code of the registrant)

- ●

- Any Positive or negative adjustments required to be made for Import of goods (Box 7)

- ●

- The value of purchases and expenses incurred during the tax period if you are seeking to claim the input tax, and the refundable tax value (Box 9)

VAT 201 Return Form on the FTA portal

A registrant may recover the input tax incurred on the purchase of goods and services provided that records of expenses and supporting documentation such as tax invoices are retained that determine the value of VAT charged by suppliers, and which proves that VAT was paid on such goods or services.

Input Tax can be claimed on purchases / expenses that are used to make taxable supplies by the business. The total tax incurred during any tax period should be disclosed in the relevant tax return for that relevant tax period.

Note: Input VAT for purchases / expenses can be claimed when the consideration for the supply is paid or will be paid within 6 months from the date of supply of the relevant transaction.

Non-recoverable Input Tax

The Input VAT incurred on purchases / expenses are non-recoverable if they be fall in one of the below categories:

- ●

-

Entertainment costs

Entertainment costs provided to anyone who is not employed by the taxable person such customers, potential customers, officials, or shareholder or other owners or investors are non-recoverable.

Ex - hospitality of any kind, including the provision of accommodation, food and drinks which are not provided in a normal course of a meeting, access to shows or events, or trips provided for the purposes of pleasure or entertainment

- ●

-

Employee-related expenses

Goods or services provided to employees without charging and for their benefit will be considered as entertainment costs with the exception provided in the following scenarios:

- ●

- There is a legal obligation provide to those Services or Goods to those employees under any applicable labor law in UAE.

- ●

- There is a contractual obligation or documented policy to provide those services or goods to those employees in order enhance their performance and it can be proven to be normal business practice in the course of employing those people.

- ●

- When such goods or services provided are deemed supply under UAE VAT law.

- ●

-

Motor vehicles used for personal purposes

If a registered business has purchased, rented or leased motor vehicles for business purpose but instead it was used for personal purposes by a person in the business, then the Input tax paid on purchase, rent or lease of the motor vehicle shall be non-recoverable.

A motor vehicle is considered road vehicle designed or adapted for the conveyance of not more than 10 people, including the driver.

A motor vehicle used in the business will not be treated as being available for personal use in the following cases:

- ●

- It is a taxi licensed by a competent authority within UAE.

- ●

- It is registered and used for the purpose of an emergency vehicle, including by police, fire, ambulance or similar emergency service.

- ●

- It is used in a vehicle renting business, where it is rented to a customer.

United Arab Emirates

United Arab Emirates