United Arab Emirates (UAE)

Corporate tax (“CT”)

Business Restructuring Relief Corporate Tax Guide

In April 2024, The Federal Tax Authority (“FTA”) published CT guide CTGBRR1 on Business Restructuring Relief. The guide is issued with the purpose of providing guidance on Business Restructuring Relief available under Article 27 of the UAE Corporate Tax Law.

The guide provides readers with an overview of the following in respect of the Business Restructuring Relief:

- ●

- Transactions covered within scope of the relief,

- ●

- Conditions to be eligible for the relief,

- ●

- Consequences of electing for the relief,

- ●

- Circumstances when the relief will be clawed back and consequences of clawback of the relief,

- ●

- Compliance requirements, and

- ●

- Interaction with other provisions of the UAE corporate tax law

Click here to read the official guide

Investment Funds and Investment Managers Corporate Tax Guide

The Federal Tax Authority (“FTA”) published CT guide CTGIFM1 on Investment Funds and Investment Managers. The guide is issued with the purpose of providing guidance on helping people understand the UAE Corporate Tax treatment for investment funds, investors, and investments with the assistance of Investment Managers.

This guide explains some of the terms and conditions in the Corporate Tax Law, and sets out the following:

- ●

- An overview of the meaning of Qualifying Investment Fund and Investment Manager,

- ●

- Conditions for a Qualifying Investment Fund to be exempt from Corporate Tax,

- ●

- Conditions for a Real Estate Investment Trust (“REIT”) to be exempt from Corporate Tax,

- ●

- Tax implications for an investor investing in a Qualifying Investment Fund,

- ●

- Conditions for a foreign person to benefit from the Investment Manager Exemption as specified under Article 15 of the Corporate Tax Law, and

- ●

- Relevant Corporate Tax compliance requirements for the above.

Click here to read the official guide

Value Added Tax (‘VAT’)

Performing the function of Director on a Board of Directors by a Natural person

The UAE’s Federal Tax Authority (“FTA”) issued VAT Public Clarification VATP037 on Performing the function of Director on a Board of Directors by a Natural person and replaces VAT Public Clarification VATP031. The new Public Clarification highlights key changes made to the Cabinet Decision No. 52 of 2017 on the Executive Regulation of the Federal Decree-Law No. 8 of 2017 on Value Added Tax (“VAT Executive Regulation”) in respect of the VAT obligations imposed on members of Boards of Directors (“BOD”).

With effect from 1st January 2023, the performance of a Director’s function, by a natural person and for a remuneration (monetary or in kind), on a Board of Directors of any government or private sector entity, shall not be a supply of services for VAT purposes which revokes the previous decision where such functions were considered to be services subject to VAT at the standard rate of 5%.

Key Highlights

- ●

-

Directors’ services shall not to be considered as a supply of services for VAT provided the conditions below are met:

- ●

-

The services are provided by a natural person (does not extend to a legal person, whether private or public, who may delegate in its own name a natural person to act as Director).

- ●

-

The person is appointed as a director on a BOD of any government/private entity.

- ●

-

In case the services are performed by Directors who are not resident in the UAE, these services will evidently also be excluded from the qualification of “supply of services for UAE VAT purposes”. There will be no application of the reverse charge mechanism or need for the natural person to register in the UAE for VAT purposes.

- ●

-

Transitional provisions

In accordance with the new Public Clarification, determining the VAT treatment for the provision of services by a BOD member will depend on the date on which such supplies took place.

In other words, to assess whether the provision of BOD members’ services are subject to UAE VAT under the old legislation or out of scope of UAE VAT under the new legislation, the following steps must be undertaken by the BOD member:

- ●

- Assume, in all cases, that the ‘provision’ of services is a ‘supply of services’ for UAE VAT purposes, and hence, subject to the provisions regulating the date of supply for UAE VAT purposes.

- ●

- Determine the date of supply under the general date of supply rules apply as per Article 25 (Date of supply) – clause (6) and (7) of the VAT Decree-Law.

- ●

- Assess the applicability of Article 26 of the VAT Decree-Law in respect of the date of supply in special cases. If applicable, disregard the date of supply determined under step 2 above and re-determine the date of supply under Article 26 of the VAT Decree-Law.

- ●

- Assess whether the date of supply falls prior or subsequent to 1 January 2023

- ●

- Based on the outcome of step 4 above, determine the VAT treatment in accordance with applicable conditions.

- ●

-

BOD members must also carefully assess their registration and deregistration obligations. In simple terms, where a BOD member has previously registered for VAT based on the provision of BOD member services, the BOD member may find itself required to deregister if they no longer meet the minimum requirements for continued VAT registration.

Click here to read the official public clarification

General News

Professional Standards for Tax Agents

The Federal Tax Authority (“FTA”) has released FTA Decision No. 1 of 2024 on Professional Standards of Tax Agents which outlines the mechanism of application of black points system to Tax Agents on violation of professional standards or code of ethics prescribed by FTA.

With effect from 1st July 2024, Black points shall be imposed on Tax Agents in the event of a violation of different categories of Code of ethics like Confidentiality, Integrity, Objectivity, Professional Behavior and Professional Competence.

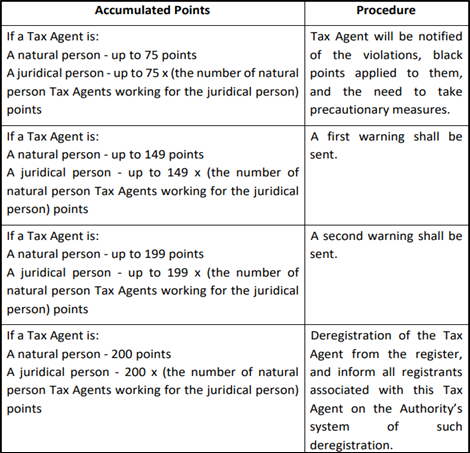

Different consequences would be faced by Tax Agents based on the slab of accumulated which ranges from notifying Tax Agent to deregistration of Tax Agent from the tax register.

The Authority shall apply the following procedures based on accumulation of points according to the following table:

Black points shall expire in accordance with the deadlines specified in the table attached to this Decision in Article 5 (“Procedures”).

Click here to read the official decision

Kingdom of Saudi Arabia (KSA)

E-invoicing Updates – Wave 11 of the Implementation (Integration Phase)

The Zakat, Tax, and Customs Authority (ZATCA) have announced the criteria for selecting Taxpayers in Wave 11 for Implementing (Integration Phase) of E-invoicing.

The 11th wave shall include all taxpayers whose taxable revenues exceeded 15 million Saudi Riyals during 2022 or 2023 would fall under the criteria the criteria for Wave 11 and should integrate their e-invoicing solutions with (FATOORA) Platform starting from 1st November 2024.

Click here to read the official announcement

ZATCA amends RETT Implementing Regulations

The Zakat, Tax and Customs Authority (ZATCA) has amended the Real Estate Transaction Tax Implementing Regulations. The new amendments include:

- ●

-

With reference to the RETT exemption involving transfer of ownership from an individual to a company, ZATCA clarified that such property must be recognized as an asset in the books of accounts before the effective date of the implementing regulations and such individual must be a shareholder in the company on the date of recognizing the asset in the books of accounts irrespective of the fact that he is a shareholder on the date of transfer of title or not

- ●

-

Amendments to the due dates for (construction, ownership, operation and transfer) projects. With respect to the tax due date to cover build, own, operate and transfer (BOOT) transactions, the tax shall be payable within 30 days from the date of transfer of ownership or possession of property to the transferee

- ●

-

Change in percentage of shareholding in a company or units of a fund due to the public offering of shares will not be considered as a breach of condition for availing RETT exemption.

- ●

-

Amending the scope of the exemption to real estate transactions involving in-kind subscription to any real estate investment fund established in line with the Capital Market Authority CMA guidelines

Key amendments are as follows:

- ●

-

It shall include all real estate fund types of whichever purpose. An initial restriction with respect to funds with the purpose of leasing real estate is now removed.

- ●

-

The requirement with respect to in-kind subscription only upon the initial establishment of funds is now removed.

- ●

-

The fund units or shares corresponding to the real estate disposal must not be disposed of until the date of termination or liquidation of the fund, or for a period of five years from the date of registration or ownership of the units or shares, whichever comes first to avail the exemption

Click here to read the official announcement

OMAN

Automatic Exchange of Information

The Official Oman Tax Authority (“OTA”) has announced the introduction of the new Automatic Exchange of Information (AEOI) system which brings along with it the following updates.

- ●

-

As per the Enrollment requirement, all entities will be required to register for Common Reporting Standard (CRS) and Country-by- Country (CbC) reporting

- ●

-

There shall be no requirement for CbC notification submission for the fiscal year 2023

- ●

-

the deadline for CRS reports submission for the fiscal year 2023 is 31st May 2024 and taxpayers are urged to adhere to this deadline to avoid any administrative penalties

Click here to read the official announcement

QATAR

Qatar signs tax treaty and investment protection agreement with Bangladesh

The Government of Qatar and the Government of the People's Republic of Bangladesh have signed a treaty to avoid the double taxation of income and combat tax evasion. This treaty shall strengthen the economic ties between and Qatar and Bangladesh along with fostering a more attractive environment for individual investors and businesses, encouraging increased commercial activity and smoother capital flow.

The agreement also covers provisions for collaborations in maritime and air transport, dividends, interest, and royalties, solidifying the economic relationships between the two friendly nations.

Click here to read the official announcement

United Arab Emirates

United Arab Emirates