Page 17 - Premier Brains Global -Doing Business in UAE (Low Res)

P. 17

DOING BUSINESS in UAE

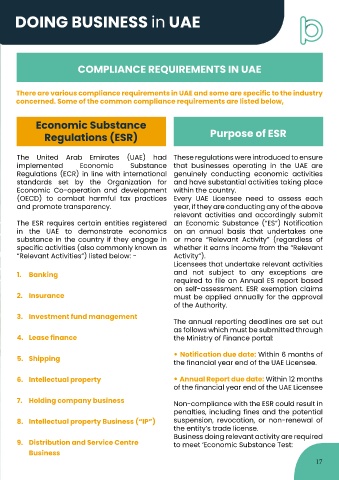

COMPLIANCE REQUIREMENTS IN UAE

There are various compliance requirements in UAE and some are specific to the industry

concerned. Some of the common compliance requirements are listed below,

Economic Substance

Purpose of ESR

Regulations (ESR)

The United Arab Emirates (UAE) had These regulations were introduced to ensure

implemented Economic Substance that businesses operating in the UAE are

Regulations (ECR) in line with international genuinely conducting economic activities

standards set by the Organization for and have substantial activities taking place

Economic Co-operation and development within the country.

(OECD) to combat harmful tax practices Every UAE Licensee need to assess each

and promote transparency. year, if they are conducting any of the above

relevant activities and accordingly submit

The ESR requires certain entities registered an Economic Substance (“ES”) Notification

in the UAE to demonstrate economics on an annual basis that undertakes one

substance in the country if they engage in or more “Relevant Activity” (regardless of

specific activities (also commonly known as whether it earns income from the “Relevant

“Relevant Activities”) listed below: - Activity”).

Licensees that undertake relevant activities

1. Banking and not subject to any exceptions are

required to file an Annual ES report based

on self-assessment. ESR exemption claims

2. Insurance must be applied annually for the approval

of the Authority.

3. Investment fund management

The annual reporting deadlines are set out

as follows which must be submitted through

4. Lease finance the Ministry of Finance portal:

• Notification due date: Within 6 months of

5. Shipping

the financial year end of the UAE Licensee.

6. Intellectual property • Annual Report due date: Within 12 months

of the financial year end of the UAE Licensee

7. Holding company business

Non-compliance with the ESR could result in

penalties, including fines and the potential

8. Intellectual property Business (“IP”) suspension, revocation, or non-renewal of

the entity’s trade license.

Business doing relevant activity are required

9. Distribution and Service Centre to meet ‘Economic Substance Test:

Business

17