What is The Lease Term of Cancellable Property Rental Contracts Under IFRS 16?

Scenario:

A company has entered into a rental agreement for an office. The agreement gives the option to either parties to terminate by giving a specific notice of 30 days. The agreement is for 3 years with extension clause. The company does not intends to close the office

The questions to considered here are about the lease term and its accounting.

Premier Brains Interpretation

The provisions about lease term extension and termination are very common. These provisions affect the lease accounting and the lease term.

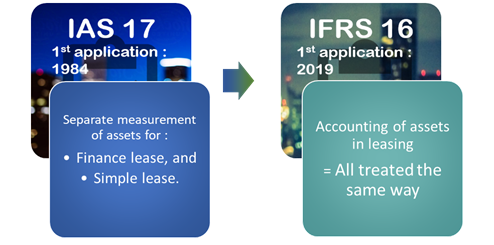

The new lease standard IFRS 16 has changed the accounting for leases. This standard is effective from 1 January 2019.

Under IAS 17, the rental expenses were booked as an expense in the income statement. However, under IFRS 16, the accounting has been redefined as under:

- ●

- A right of use asset and a lease liability is recognized in the statement of financial position.

- ●

- The right of use asset is amortized over the life of lease

- ●

- The lease liability is reduced by lease payments and the finance cost is accrued every year

- ●

- The period of lease is based on estimated period, the lease is likely to be renewed in future.

- ●

- The rate of interest for accruing the lease liability is the incremental borrowing rate of the entity.

If you would like to discuss any IFRS 16 related matters, please drop us an email at info@premier-brains.com or call us at + 971 4 3542959.

United Arab Emirates

United Arab Emirates