Accounting Standard IFRS 16 on Leases

Impact on financial statements, business valuation and impairment assessment under the current economic slowdown

Brief Background and reason for bringing new standard

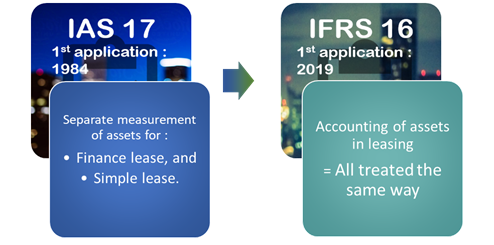

IFRS 16 is a the lease accounting standard published by the International Accounting Standards Board (IASB) in January 2016. IFRS 16 changes the way that companies account for leases in their financial disclosures, especially their balance sheets and income statements. It replaces an earlier international lease accounting standard – IAS 17. The purpose of IFRS 16 is to close a major accounting loophole from IAS 17: off-balance sheet operating leases. IFRS 16 is effective for reporting periods that began after 1 January 2019 for entities reporting under international financial reporting standards.

GET A FREE CONSULTATIONWhat’s the major change under this standard?

IFRS 16 has brought about a lot of changes to the existing treatment of leases, especially for lessees. Probably everyone, even if not significantly affected by this accounting standard, remembers at least the most important change: in many cases the lessees will now have to recognize their operating lease on balance sheet which means to record a right-of-use (ROU) asset and a lease liability.

Do we have to Right-of-use asset under IFRS 16 for Impairment?

Yes, this new accounting treatment has an impact of impairment of the ROU assets following IAS 36 (impairment of assets).

Does it mean I have to test for an impairment?

Considering the current scenario of slow down in economy due to Covid 19 and generally, also the requirement to test ROU for impairment is a must. With some exemptions and under the requirements of IAS 36. , the test for impairment is a must The impairment of ROU assets recognized by a lessee is fairly similar to the accounting for impairment of a leased asset by a lessor in case of operating leases under IAS 17.

There are only two exemptions from the IAS 36 impairment model:

- 1

- when a lessee applies a fair value model under IAS 40 for its investment properties, it shall also apply fair value model to the ROU asset and;

- 2

- if ROU assets relate to a class of PPE to which the lessee applies the revaluation model under IAS 16, then the lessee can elect to apply the revaluation model to all of the ROU assets that relate to that class of PPE.

How does it work in practice?

General IAS 36 provisions apply to the lease asset and lease liabilities in the same way as for all other assets under the IAS 36 scope. The ROU asset is tested for impairment on a single standalone basis unless it generates cash inflows only in combination with other assets, together forming a cash-generating unit (CGU). Such a ROU asset will be tested for an impairment as a part of this larger CGU and included in its carrying amount.

Another question arises, whether the lease liabilities should these be included in the CGU carrying amount and recoverable amount as well or only the ROU asset should be assessed for impairment. The response depends on the situation because IAS 36.78 provision requires us to consider whether, upon a sale of the CGU, the buyer will also be required to assume the liability. In such a case the liability, and potentially the lease liability, needs to be included in the recoverable amount of the CGU and by analogy in the carrying amount of CGU as well. The conclusion of whether the buyer is required to assume the lease liability will depend on facts such as a whether the CGU is a legal entity, the lease contract terms, etc.

What is impact of IFRS 16 on Financial Statements?

Below are some of the relevant changes expected due to implementation of IFRS 16

Balance sheet

The impact on the balance sheet will be twofold, the recognition of a right-of-use asset and a lease liability. As a result, companies that have previously had significant off-balance sheet leases will now show higher assets and higher liabilities.

Cashflow statement

IFRS 16 is expected to impact the classification of cash flows generated through operating and financing activities. Overall there will be no impact on the total cash flows.

Profit and loss statement

The lease expense recognised under IAS 17 will now be shown as depreciation of the right-of-use (“ROU”) asset to be recognised on the balance sheet as well as an interest expense. As a result of implementing IFRS 16, operating expenses will be lower, interest expense will be higher, and EBITDA (Earnings before interest, tax, depreciation and amortization) and EBIT (Earnings before interest & tax) will be higher. A snapshot can be seen as below,

What is the impact of IFRS 16 on business valuation?

IFRS 16 will have a significant impact on companies that have relied on off-balance sheet financing in the form of operating leases, particularly in the airline, retail, transportation, telecommunication, and energy sectors.

Discounted Cashflow Method (“DCF”)

IFRS 16 will impact Net Present Value (“NPV”) of free cashflows to the firm (“FCFF”) are expected to be higher resulting in a higher Enterprise Value (“EV”). The higher NPV of FCFF are a result of a higher EBITDA and lower WACC. The WACC is expected to be lower as a result of a higher Debt/Equity mix in the capital structure of used to determine the capital structure. Although the Enterprise Value will increase, equity value should ideally not be affected (conceptually increase in enterprise value should be offset by the increase in net debt).

Capturing cashflows related to leases into perpetuity

Before IFRS 16 was implemented, all lease expenses for operating leases were captured in operating expenses and hence, included in the determination of EBITDA. However, post IFRS 16 there will no longer be an operating expense for leases, but rather a depreciation (non-cash expense) and interest expense which are not captured within EBITDA. Further, increase in net debt appearing in balance sheet only captures the present value of lease obligations for the remainder of the lease term, so when using the DCF method, care should be taken to ensure cash outflows related to the continuation of the leases into perpetuity are considered in valuing the business. Continuity of lease obligations shall be considered into perpetuity rather than what was present in the balance sheet on date of valuation.

Depreciation expense

Prior to IFRS 16 normal assumption is that Capex eventually equals to depreciation expenses, however post IFRS 16, depreciation also include lease assets thus present value of lease obligations in the balance sheet also be considered while reviewing the company valuation.

Market Approach

Using Market Approach for valuation is also affected by IFRS 16. Multiples based on Enterprise Value such as EV/EBITDA will be affected as EV and EBITDA will both be higher. EV increases as a result of recognising the P.V. of lease liabilities and EBITDA increases due to the removal of the lease expense.

While checking the comparable companies and especially the data on which it is based relates to period prior to implementation of IFRS 16, so its impact on the overall valuation needs to be looked at.

GET A FREE CONSULTATIONArticle compiled by: Mr. Rishi Aggarwal (Partner – Audit & Assurance)

If you would like to discuss any matters relating to this article, please drop us an email at info@premier-brains.com or call us at +971 4 3542959.

United Arab Emirates

United Arab Emirates