WPS Defination

Although WPS was introduced in July 2009 by MOHRE with the Ministerial Decree No. 788, many new or old employers still struggle to understand what it is and how it works and more importantly whether they are legally obliged to practice this as per UAE’s Labor LAW.

Basically, the WPS is electronic wages transfer system that oversees the payment of workers’ salaries in the UAE through banks and approved financial institutions. It ensures that UAE workers are paid the right wages or salaries (based on their employment contracts) and in a timely fashion.

Importance

WPS is a mandatory legal requirement in the UAE for businesses registered under the Ministry of Human Resources and Emiratisation (MoHRE) across all sectors and industries as well as companies in certain free zones such as Jebel Ali Freezone (JAFZA) must comply with WPS regulations.

Such registered companies must adhere to this system as their mode of salary payment, as per the due dates.

DMCC Implements WPS

DMCC offers a wide range of world-class financial services, trading resources, and investment platforms and provides easy access to the world’s key commodities markets.

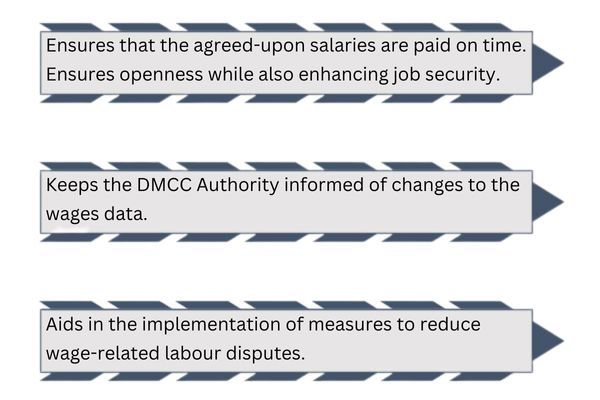

This WPS service will be introduced starting on February 15, 2023, as required by DMCC, to safeguard the fundamental rights of both employees and employers in our business hub. This will streamline and ensure that free zone employees receive their wages on time from their employers, and which successfully monitors the process to ensure transparency and security, is one that all registered DMCC member companies are obligated to follow.

Previously, to curb unscrupulous practices and enhance employee welfare, DMCC Free Zone has been working on adopting wage protection system (WPS) for firms registered with them.

DMCC Free Zone will be the second Free Zone after JAFZA to fully adopt the use of WPS.

Steps to Follow

What steps to be followed by DMCC Companies in order to register their staff members for the WPS?

- 1.

- Designate a member of your HR team to carry out the duties required for active participation in the WPS.

- 2.

- Identify the employees who have a bank account and who do not have a bank account.

- 3.

- Login to DMCC Member Portal to generate the report with the Employer and Employees ID (Select "My Reports" and then "WPS Salary - Current Month" to extract the report.)

- 4.

- Fill out the information for the bank accounts and exchange houses of the employees.

- 5.

- Approach the Bank/Exchange House to submit the report for the salary file(s) creation (SIF)

- 6.

- Transfer the salary as per the due date agreed in the employment contract.

Benefits of WPS

Payment Process

Noncompliance

However, noncompliance will lead to actions such as

Payment delays

In the case of payment delays, the penalties and fines vary by the size of the company.

For companies with 100 or more employees, the following apply if they fail to pay employees’ wages or salaries within 10 days of the wages or salary due date (based on the employment contract):

- ●

- Starting from the 16th day from the date of the delay in wages or salaries (which is the 26th day from the wages or salaries due date), the company will not get any work permits.

- ●

- The owner(s) of the company cannot register new companies.

- ●

- The MOHRE will take actions against other companies owned by the owner(s) of the defaulting company.

- ●

- Employees bank guarantees will be liquidated.

- ●

- The company will be downgraded to the third category.

- ●

- Workers will be allowed to move.

If the wages are delayed for over 60 days, a fine of AED 5,000 per employee (whose wage has been delayed) will be charged up to a maximum fine of AED 50,000 for multiple employees. While companies with less than 100 employees delay payment for up to 60 days, the following penalties will apply:

- ●

- Work permits ban

- ●

- Fines

- ●

- Referral to court

If such a delay (up to 60 days) occurs twice a year, MOHRE will treat the companies like those that have more than 100 employees.

Please note that this article is for information purposes only and should not be construed as an advice. It does not necessarily cover every aspect of the topics with which it deals. You should not act upon the contents of this alert without receiving formal advice on your particular circumstances.

If you would like to discuss further, please drop us an email at info@premier-brains.com or call us at + 971 4 3542959.

“ALWAYS DOING THE RIGHT THING”

United Arab Emirates

United Arab Emirates