Recently Oman tax authority issued guidance document on Country by Country Reporting (CbCR), following are the key highlights of the guidelines.

Why CbCR Required?

The purpose of CbCR is to eliminate gap in information between the taxpayers and tax administrations with regards to information on where the economic value is generated within the MNE Group and whether it matches where profits are allocated and taxes are paid on a global level.

Applicability of CbCR for Entity in Oman (must be part of Multinational entities “MNE” Group):

- ●

- Any Group having two or more enterprises that are tax residents in different jurisdictions ;or

- ●

- An Enterprise that is resident for tax purposes in one jurisdiction and is subject to tax with respect to the business carried out through a permanent establishment in another jurisdiction.

Threshold for CbCR Reporting

- ●

- Total consolidated revenue of Group is equal to or more than OMR 300 million for the financial year preceding the reporting year concerned.

General CbCR Report guidance

Data Source : Person has to take data from Consolidation reporting packages or statutory financial statements or internal management accounts and this has to be consistent year on year

Currency: Reporting should be in functional currency of MNE Group (e.g OMR or USD) and conversions (if any) should be made at average exchange rate and source to be mentioned in Table 3 of CbCR report

Year of data to be included: For Ultimate Parent Entity – Group financial year and for other constituent entities – Group financial year or local financial year

Specific Guidance on preparation of CbCR report

CbCR Report is bifurcated in 3 tables

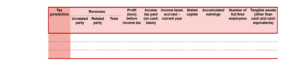

Table 1: Contains the quantitative information per tax jurisdiction such as Revenue, stated capital, taxes accrued and paid, employee count, etc

Following key points should be considered while reporting in Table 1

- ●

- Reporting needs to be done on Aggregated basis and not consolidated basis within a jurisdiction

- ●

- Rounding off is not allowed in thousands, millions etc. (whole amounts to be reported)

- ●

- Revenue should include include extraordinary income and gain from investment activity, but exclude dividends from other constituent entities.

- ●

- Related parties mean the constituent entities of the MNE Group

- ●

- Income tax accrued include current year tax accrued, current year tax paid including Advance tax, WHT, Tax paid under protest and prior year tax arise on dispute. Also, refund needs to be deducted from this and same information needs to be provided under Table 3.

- ●

- For PEs, stated capital and accumulated earnings to be reported under legal entity and not PE

- ●

- Employees should be reported as of year-end on Full Time Equivalent basis including the independent contractors.

Table 2: Contains the qualitative information per constituent entity on the main business activities undertaken during the year, MNE should tick the relevant box for one or more main business activity done by them.

Table 3: Contains any additional information necessary to facilitate the understanding of Tables I and II,

Below are the few of the required disclosures

- ●

- Data source.

- ●

- Reporting periods of constituent entities.

- ●

- Tax refunds included in ‘revenue’ or reduced ‘income tax paid’

- ●

- Description of ‘Other’ activities selected in Table 2.

- ●

- Whether any part year information is included (In case of mergers / demergers).

- ●

- Reasons in case Tax ID numbers of certain entities are not available.

- ●

- Assumptions made with respect to computation of FTE employees.

- ●

- If accumulated earnings include negative figures.

- ●

- Exchange rates.

- ●

- Explanations about any inconsistencies on a year-on-year basis.

Submission of CbC reports

CbCR notifications and reports should be submitted through Oman tax authority AEOI portal https://aeoi.taxoman.gov.om/

Applicable MNE groups will need register on the system through enrolment process

CbCR Notification:

During the notification filling following key information needs to be provided:

- ●

- Business activity of the notifying entity.

- ●

- Identification whether filing is made by Ultimate parent entity (UPE) / Surrogate parent entity (SPE) or constituent entity;

- ●

- Name of the MNE Group.

- ●

- Name, TIN and jurisdiction of the UPE/ SPE (in case of notification by other constituent entities)

CbCR notification submitted on the existing notification system will need to be resubmitted on the new CbCR portal. However, the notification needs to be submitted only by the UPE of the Oman headquartered MNE Groups. In view of this, the notification on the portal includes only the information about the UPE and not about the other constituent entities of the MNE Group in Oman.

Submission of CbCR Report:

Once the notification is submitted, the CbCR Report can be filed.

The filing should be in an ‘XML’ format compliant with the OECD XML Schema 2.0. Further information on the OECD XML Schema 2.0 (user guide and template schema file) can be obtained from the OECD website.

Please note that this memo is for information purposes only and should not be construed as an advice. It does not necessarily cover every aspect of the

topics with which it deals. You should not act upon the contents of this alert without receiving formal advice on your particular circumstances.

If you would like to discuss Tax & VAT services or ESR or CBcR , please drop us an email at info-oman@premier-brains.com or call us at +968 9808 1315 and /or + 971 4 3542959.

“ALWAYS DOING THE RIGHT THING”

United Arab Emirates

United Arab Emirates