In February 2022, UAE’s Federal Tax Authority (FTA) has published amendments on the voluntary disclosure user guide for VAT and Excise Tax. The updates in the guide aims to provide an overview of the complete voluntary disclosure application process for active and de-registered tax groups.

A voluntary disclosure should be made by a taxpayer to notify the FTA of an error or omission in a tax return, tax assessment or tax refund application

Conditions for Filing a Voluntary Disclosure:

A voluntary disclosure can be submitted in the following specific scenarios:

- ●

- Where a filed tax return or a tax assessment is incorrect resulting in underpaid tax amounts to more than AED 10,000;

- ●

- Where a filed tax return or a tax assessment is incorrect resulting in underpaid tax amount of less than AED 10,000 and there is no VAT return through which the error can be corrected;

- ●

- Where a filed tax refund application is incorrect resulting to a refund amount more than what the taxpayer should be entitled.

Due date of Filing a Voluntary Disclosure:

The below table shows the time limits for filing voluntary disclosure:

| Change in Calculation of Tax Payable as a result of error | Consequences | Time Limit |

|---|---|---|

| More than AED 10,000 | File Voluntary Disclosure | 20 Business Days from the date of becoming aware of the error |

| Less than AED 10,000 | Correct the error in the Tax Return period in which error has been discovered | Due date of Submission of respective return |

| Less than AED 10,000 | If there is no return through which error can be corrected the Tax payer must file a voluntary disclosure | 20 Business Days from the date of becoming aware of the error |

Voluntary Disclosure for Tax Groups

Voluntary disclosures for Tax Group must be submitted by the representative member of the tax group or the last representative member before the tax group was deregistered.

How to submit a Voluntary Disclosure for Tax Groups

| SCENARIO | ACTIVE TAX GROUP | DEREGISTERED TAX GROUP |

|---|---|---|

|

Against a VAT return filed |

Go to the “VAT201- VAT returns for Tax Groups” tab in the VAT section.

Click on the “Submit Voluntary Disclosure” button on the row of the VAT return against which Voluntary Disclosure should be submitted. |

Go to the “VAT211- VAT returns for Tax Groups” tab in the VAT section.

Select the TRN of the deregistered tax group from the drop down.

Click on the “Submit Voluntary Disclosure” button on the row of the VAT return.

|

|

Against an Acknowledged Voluntary Disclosure |

Go to the “VAT211- Tax Group VAT Voluntary Disclosure/Tax Assessment” tab in the VAT section.

Click on the “Submit Voluntary Disclosure” button on the row of the Acknowledged Voluntary Disclosure against another Voluntary Disclosure should be submitted

|

Go to the “De-registered Tax Group Voluntary Disclosure” section.

Click on the “Submit Voluntary Disclosure” button. |

|

Against a VAT Tax Assessment |

Go to the “VAT211- Tax Group VAT Voluntary Disclosure/Tax Assessment” tab in the VAT section and scroll down to the Tax Assessment section.

Click on the “Submit Voluntary Disclosure” button on the row of the Tax Assessment against which the Voluntary Disclosure needs to be submitted.

|

Go to the “De-registered Tax Group Tax Assessment” section.

Click on the “Submit Voluntary Disclosure” button. |

How to fill in the Voluntary Disclosure form

- ●

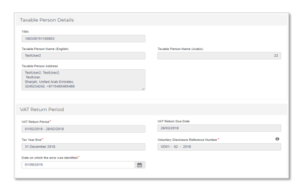

- The details of the taxable person and the VAT return period for which Voluntary Disclosure is being filed against are already pre-populated.

- ●

- Date on which the error is identified should be indicated. In case of multiple errors, date on which the first error is found should be used.

- ●

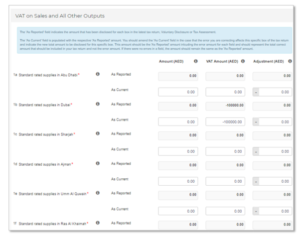

- The Voluntary Disclosure is divided into two sections:

- 1.

- As Reported: These are pre-populated amounts which are the figures disclosed in the latest VAT return, Voluntary Disclosure or Tax Assessment

- 2.

- As Current: the corrected values for each box; these values should be the total values that should have been reported for that period and not the error amounts.

- ●

- A letter providing background facts, reasons for the Voluntary Disclosure, detailed description of the error(s) disclosed in the Voluntary Disclosure form, the error(s) disclosed as well as the impact on the relevant sections/boxes of the return must be uploaded.

- ●

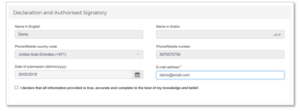

- The details of the Authorized signatory are pre-populated and must be reviewed as well as the declaration.

- ●

- Once all information in the Voluntary Disclosure form is filled out, click on the ‘Submit’ button at the bottom right-hand corner of the portal.

Payment of dues

- ●

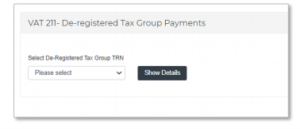

- The last representative member of a deregistered tax group can make the payments related to the liabilities created from the Voluntary Disclosures applied in the “VAT211 – Deregistered Tax Group Payments” tab in the VAT section.

- ●

- TRN of the deregistered tax group against which payment needs to be made for should be selected from the drop down. The total outstanding liabilities will be available and the member can enter the amount they wish to pay.

Please note that this memo is for information purposes only and should not be construed as an advice. It does not necessarily cover every aspect of the

topics with which it deals. You should not act upon the contents of this alert without receiving formal advice on your particular circumstances.

If you would like to discuss Tax & VAT services, please drop us an email at info@premier-brains.com or call us at + 971 4 3542959.

“ALWAYS DOING THE RIGHT THING”

United Arab Emirates

United Arab Emirates